We all know goals are vital in both business and personal life. Most of us make financial plans with certain goals in mind. We usually use the annual period as a guide to how we're doing. But a mid-year financial checkup is a great tool to catch problems early. Also, it is a great time to make any spending or budget changes that could benefit you.

Read MoreFinancial Planning Insights

While you might not feel like early adulthood is a time to worry about financial planning, there are plenty of building blocks that can actually be put into place early on. It can be hard to think about future planning when it comes to finances, but there are simple habits and tips that can help shape your spending and financial goals for years to..

Read MoreAs a physician, you’ve dedicated your life to taking care of other people. It's time to start taking care of yourself and building a strong financial plan for your future. For physicians, balancing paying back school debts, saving for retirement, and managing a practice can take away from what's important—providing great service to your patients...

Read MoreFinancial planning is so important so that you can live comfortably now and in the future when you want to retire. You also want to invest wisely so that your money will continue to grow. A financial advisor is great when it comes to organizing your finances, putting you on a budget, and helping you to plan for the future. However, it can be hard..

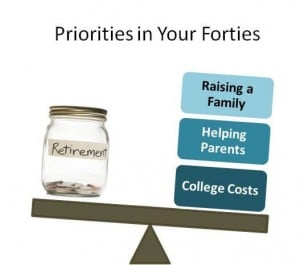

Read MoreAlthough it may seem a bit early to think about retirement, people in their forties should already have a plan in place. But don't let that discourage you if you don't—there is still time to build wealth in your 40s. Social security benefits are not enough to support you, so formulating a plan early will save you from working longer than you want...

Read MoreMost parents want more for their children than they had. This includes a good college education. However, as the cost of a college education continues to rise, it becomes more out of reach. For this reason, it is important to plan and save for college so that you can afford to help your children reach their goals. Planning financially for college..

Read MoreCOVID-19 has negatively impacted most people. There are very few of us who can say their financial situation has improved in the face of this pandemic. Whether it is a loss of a job, stock market investments, or the loss of a loved one, we are all feeling it in one way or another. So we are all asking the question of how to recover from financial..

Read MoreIf there is one thing we can all agree on, it is that the recent COVID-19 crisis has affected our economy. There are thousands of unemployed people, many of them unable to get unemployment compensation. Although companies are starting to open back up, the financial impact continues. It is essential that businesses and individuals have a viable..

Read MoreConfused by finances? Unsure about insurance? You’re not alone, especially if you’re breaking out for the first time on your own! After all, if financial planning weren’t so complex, there would be no need for financial experts and economists. Thankfully, you don’t need a degree in finance to protect your wallet and make smarter choices with your..

Read More

-1.png)

.png)

.png)